Renters Insurance in and around Knoxville

Welcome, home & apartment renters of Knoxville!

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Knoxville, TN

- Quad-Cities

- Powell, TN

- Iowa

- Illinois

- Tennessee

- Normal, IL

- Bloomington, IL

- Moline, IL

- Rock Island, IL

- Davenport, IA

- Bettendorf, IA

Insure What You Own While You Lease A Home

It may feel like a lot to think through your sand volleyball league, work, your busy schedule, as well as savings options and coverage options for renters insurance. State Farm offers no-nonsense assistance and impressive coverage for your electronics, linens and home gadgets in your rented home. When mishaps occur, State Farm can help.

Welcome, home & apartment renters of Knoxville!

Coverage for what's yours, in your rented home

Open The Door To Renters Insurance With State Farm

You may be wondering if Renters insurance is really necessary, but what many renters don't know is that your landlord's insurance generally only covers the structure of the space. How much it would cost to replace your personal property can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when abrupt water damage from a ruptured pipe occurs.

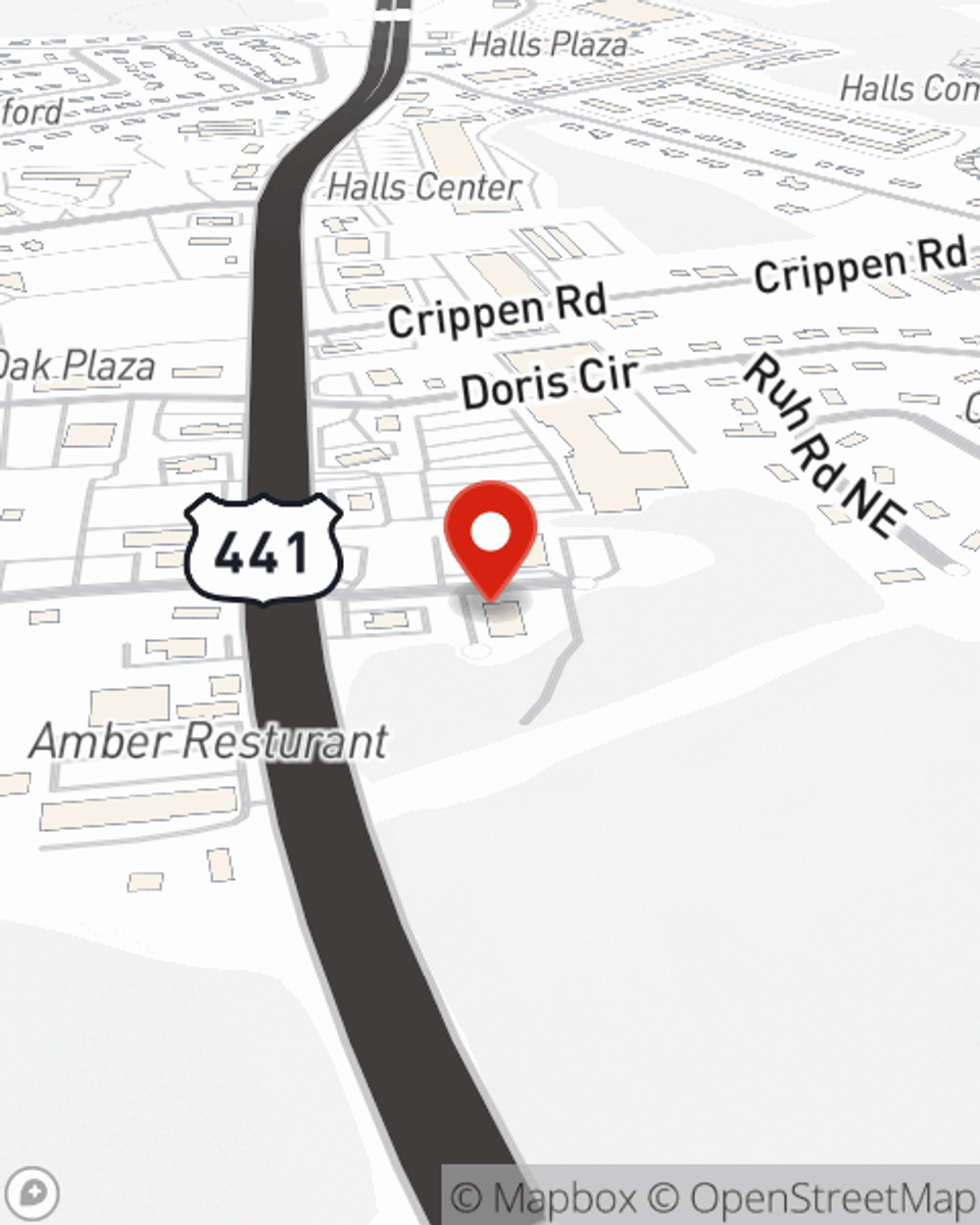

State Farm is a value-driven provider of renters insurance in your neighborhood, Knoxville. Visit agent John Diedrich today and see how you can save!

Have More Questions About Renters Insurance?

Call John at (865) 922-2195 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

John Diedrich

State Farm® Insurance AgentSimple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.